The JPMorgan Global Manufacturing PMI – which provides a single figure snapshot of operating conditions across the planet – posted 37.2 in March. Although substantially below the no-change mark of 50.0, the PMI was up for the third month in row and at its highest level since last October. The vast majority of the national manufacturing PMIs rose in March, including the US, Russia, Japan, China, most Eurozone nations and the UK.

This is however the most sustained period of contraction in the series history, and it still remains very unclear where we go from here. In general the drop in output reflects weak demand, with new orders declining for the twelfth month in a row. The trouble is, it is not at all clear where the rebound in demand that is needed for a recovery is actually going to come from.

Only last week the World Trade Organisation forecast a drop of 9% in the volume of international trade in 2009, and it is clear that in most economies output volumes continue to be hit by global as well as by local factors. That is what globalisation means, in effect, we are all interlocked.The rate of contraction in new export orders was severe, and in line with that seen for total order books.

When assesing the present situation, I think we need to keep three factors in mind: employment, inventories, and the massive stimulus packages which are being implemented.

On the employment front, the March data pointed to further job losses, as staffing levels were cut for the eleventh successive month, pointing to weakening consumer demand further along the road. The rate of decline moderated but remained historically high. All of the national manufacturing surveys for which March data were available reported reductions in employment. Denmark, the US and Czech Republic registered the fastest rates of decline.

As far as stocks go Global manufacturers continued to unwind their inventory positions in March. Stocks of purchases declined at the fastest pace in the series history. Among the national manufacturing sectors covered, only India reported a gain in input inventories. Even here, the rate of growth was marginal. So one of the reasons why output levels may bounce back slighly in the next few months is that inventory levels must now be quite low in many cases, and to some extent new orders will need to be met from production rather than from stocks. In addition, we are in the middle of the stimulus programmes, and it would be surprising if we didn't see some impact on manufacturing output from all that money being spent. Another question altogether would be whether any of this spending is capable of gaining traction. With consumers all over the developed world battening down the hatches for a long winter, and saving as hard as they can to put some order back in their balance sheets, it would be surprising if the stimulus packages on the scale we are seeing them were actually sufficient to turn all this round at this point. So the outlook is, a few months of easing in the contraction, and then more of the same.

Europe

Sweden

Sweden's seasonally adjusted manufacturing purchasing managers' index rose to 36.7 in March from 33.9 in February, but the index remained below the threshold level for the ninth consecutive month in March, although this was the third consecutive month of improvement. In March, the production index rose to 38.8 from 34, while new orders index moved up to 35.1 from 28.8. The employment index increased to 31.1 from 30.1 and the inventories index rose 3 points to 39.6. Meanwhile, the prices index fell to 27.7 from 30.4.

Eurozone

The Markit Eurozone Final Manufacturing PMI for March rose from February's all-time low, up to 33.9 from 33.5. Thus the PMI signalled a marginal easing in the rate of decline from the previous month's record pace. Output showed the weakest decline for five months, and a smaller fall than the Flash estimate, although the rate of decline remained well above that seen prior to last October. With the exception of Italy, Austria and Greece, rates of contraction eased in each of the eight countries surveyed.

The Netherlands saw the smallest (though still steep) drop in production, while Spain saw the sharpest decline for the eleventh straight month. By product, investment goods producers reported the steepest fall in production for the third successive month, closely followed by intermediate goods producers. Consumer goods firms meanwhile reported the weakest rate of decline for the seventh consecutive month. Stocks of both raw materials and finished goods fell at record rates, as companies focused on lowering their operating capacity and controlling costs. The reduction in unsold goods stock was especially steep in Ireland, Germany and France.

Germany

Declines in German manufacturing activity continued to slow in March, however, activity in the sector continues to contract at a sharp pace, the research firm added.

The German manufacturing purchasing managers index rose to 32.4 in March, up one point from February's figure and in line with both preliminary estimates and expectations. March's increase marks the second consecutive month of improvement after PMI reached a 12-year low in January of 32.0. Nevertheless, the figure remains well in contraction territory, with the average taken across Q1 as a whole notably lower than the previous quarter's figure. According to the PMI report, manufacturing output and new orders continued to contract, albeit at a reduced pace, while employment fell at a record pace over the month. "The sector's performance in Q1 was at least as bad as Q4 and therefore points to another heavy fall in GDP," Markit senior economist Paul Smith said.

Spain

The pace of decline in Spanish manufacturing slowed in March but remained at the steepest contraction rate of any eurozone country. The PMI rose in March to 32.9 from 31.8 in February and thus further off from December's record low of 28.5. All the survey's main indicators remain far below the 50 level that divides growth from contraction. Output and new orders continued to contract sharply in March but at slower rates than recorded in the last six months, with panellists blaming falling demand as the principal cause as clients cut back on spending.

"The March PMI data suggests that the pace of decline in the Spanish

manufacturing sector has slowed," said economist Andrew Harker at Markit

Economics, adding that new orders and output indices are well above record lows

posted late last year.

But Harker was at pains to stress that the March figures should not be interpreted as any sort of sign of a turnaround in the Spanish economy. Unemployment in the sector continued to rise in line with falling output requirements as joblessness in the wider Spanish economy stood at 15 percent, the highest rate in the European Union. More than 34 percent of those surveyed by Markit said they had noted reduced employment levels at the end of the first quarter. Staffing levels have shrunken continuously since September 2007, according to the survey.

Slumping demand also hit input and output costs, which both dropped to series lows in March. Input costs fell as firms negotiated better prices from suppliers, while output prices fell as these savings were passed on to customers and as scarce business fuelled greater pricing competition.

Spain's preliminary harmonised inflation fell to -0.1 percent in March, according to government data on Monday, the first negative result for over 45 years as the deepening recession weighed on price gains.

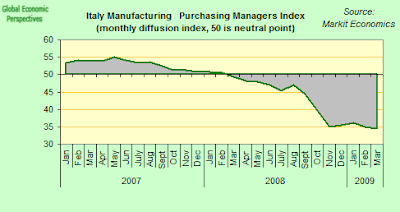

Italy

Italy once again goes against the stream, since manufacturing activity fell in Italy at its fastest pace on record in March, with the manufacturing purchasing managers index falling to a record low of 34.6, down from February's 35.0 and suggesting an unprecedented contraction in activity for the sector. Weakness was widespread, Markit said in their report. Staffing levels were cut at a record pace as firms were forced to adapt to falling workloads and declining new orders. Backlogs of work also declined at their sharpest pace in the history of the PMI as falling demand meant firms to were increasingly able to complete outstanding projects.

France

French manufacturing output fell at a slower pace in March than in February, but but the outlook remained highly fragile as demand continued to suffer and firms stepped up job cuts. The Markit/CDAF manufacturing purchasing managers' index came in at 36.5 , well still below the 50 mark separating growth from contraction. The reading was, however, better than the record series low of 34.8 seen in February.

"Although output and new orders fell at slower rates in March, the latest PMI

data still point to severe weakness in the French manufacturing sector as the

slump in demand continues," said Jack Kennedy, an economist with Markit

Economics.

Again, in a picture we get from one country after another, there was a sharp fall in inventories of finished goods. This suggests the overhang of unsold stock is diminishing, and once the destocking phase is complete, falls in production should ease for a bit, although I doubt such upticks will be enough to retart the economy given the depth of the current recession/depression. On the investment side, it was notable that those taking part in the survey said consumers and businesses were reluctant to commit to new spending.

The new orders index hit 34.3 in March from 30.1 in February, but remained deep in negative territory, marking its 10th consecutive month of contraction, according to the survey. Faced with dwindling levels of new business, firms worked through backlogs at a rapid pace, and slashed jobs to trim excess capacity, pushing the factory employment index to its second-lowest level in the series history, at 36.2.

Greece

The Greek Purchasing Managers’ Index fell to a new record low of 38.2 in March, reflecting a sharp drop in production, new orders, employment and inventories during the month. The markit economics monthly report said factory prices fell more rapidly in March, while import prices fell at a slower rate, a sign of further pressure in companies’ profits. The employment rate in the Greek manufacturing sector fell to a record low in the same month.

Eastern Europe

Hungary

Hungary's manufacturing purchasing manager index eased by 0.2 percentage points to 39.5 in March picking up from an all-time low in February, according to the Hungarian Association of Logistics, Purchasing and Inventory Management (HALPIM). The contraction of the manufacturing sector that started last October has continued, and its rate has even increased as compared to February.

Poland

In Poland, the index rose to 42.2 points, the highest in five months, from 40.8 in February. The decline in Polish industry decelerated for the third month in a row and was the least weakest rate since November. Markit said both new orders overall and new export orders continued to contract rapidly, reflecting weakening demand from western Europe, while employment fell to a new record low for the fastest rate of decline since the survey began in July 2001.

Roderick Ngotho, a strategist at UBS, pointed to German PMI data also released on Wednesday, which he said did not reflect a collapse in Germany factory orders and it was possible sentiment was "adapting to bad news". "Hence though still quite poor, it could be looking for a base in the poor side of the scale. This is different from sentiment being outright optimistic due to a positive change in global macro indicators," he said. "Without global demand picking up and with domestic demand generally weak, it is difficult to envisage a positive environment for industrial orders/output to pick up meaningfully in the near term."The Czech Republic

The Czech Purchasing Managers' Index inched up to 34.0 in March from 32.6 in February and from the record low set in January. The Czech decline was also the least extreme in five months, but the first quarter as a whole still pointed to a much steeper rate of decline than the second half of 2008, said Markit, which compiles the PMIs.

The slower rate of contraction in March could, of course, be linked to the effects of the car-scrapping subsidies introduced in some 10 EU countries in January. Carmakers are the main drivers of economies like those in the Czech Republic and Slovakia, where leading global manufacturers have set up factories this decade. Both countries have seen their sharp declines in output ease in recent weeks. Some firms, including the Volkswagen unit Skoda, have recently hired additional workers and resumed full working weeks to handle the resulting surge in orders, the problem for these economies is that the subsidy effect may only last for several months.

Russia

Russian manufacturing contracted at the slowest pace for five months in March as companies reduced their stocks of unsold goods and the decline in new business eased, according to the latest PMI report from VTB Capital. The VTB Purchasing Managers’ Index was at 42 last month after a 40.6 reading in February. Stockpiles of unsold goods fell at the fastest rate since December 2005.

“Stocks of unsold goods declined which, combined with a sluggish contraction of the new business sub-index, suggest that the headline index may keep rising into the second quarter,” Dmitri Fedotkin, a VTB economist, said in the statement. Still, “no sharp recovery” in the index is to be expected.The index showed contraction for the eighth straight month, a longer period of decline than the one registered in 1998, when the government devalued the ruble and defaulted on $40 billion of debt.

The manufacturing workforce shed jobs for the 11th month in a row, the longest period of contraction in the survey’s history, VTB said. “Firms reported that the redundancies resulted from lower workloads and the subsequent need to cut spare capacity,” it said in the statement.

Asia

China

China’s manufacturing industry shrank for an eighth straight month in March as collapsing global trade cut exports and growth across Asia. The CLSA China Purchasing Managers’ Index dropped to a seasonally adjusted 44.8 last month from 45.1 in February. So again, while the stimulus programme is slowing the rate of contraction, there is no sign of any expansion in China.

The manufacturing component of the index continued to increase, rising for a fourth month from a record low of 40.9 in November. The export orders index rose to 41.4 from 39.5 in February. New orders climbed to 43.6 from 44.2. Output gained to 44.3 from 43.9, while the employment index rose to 47.1 from 46.6, its second increase in eight months.

“A worsening of domestic manufacturing orders lies behind the drop in the PMI and accords with what we are seeing on the ground in the steel industry,” said Eric Fishwick, head of economic research at CLSA in Hong Kong. “Expect the production index to show softness in April......More encouragingly, export orders continue to improve,” he added “They are still falling but at the most moderate pace since October.”

India

Indian manufacturing activity contracted for a fifth straight month in March as demand remained depressed by the global economic downturn, although there were some signs of improvement, according to the report which accompanied the ABN AMRO Bank purchasing managers' index. The index rose to a seasonally adjusted 49.5 in February from January's 47.0, indicating slight signs of slight improvement after hitting a 44.4 trough in December, getting now very close to the reading of over 50 which signals economic expansion. "On the whole, it appears that business conditions in the manufacturing sector are gradually improving," said Gaurav Kapur, senior economist at ABN Amro Bank. Perhaps India's is the only manufacturing sector in the global economy which gives some indication of moving out of contraction and into recovery at this point.

Manufacturing, however, currently only makes up about 16 percent of India's gross domestic product. "It appears that domestic demand is picking up," Kapur said. "External demand, however, remains weak and contracted in March too, for the sixth consecutive month." The new orders index rose to 49.5 from 45.9 in February.

Americas

United States

Manufacturing in the U.S. contracted for a 14th straight month in March as factories kept on cutting production, though a spike in new orders and the lowest inventories since 1982 indicate the industry may be stabilizing to some extent, whether in the short term or the longer term remains to be seen. The Institute for Supply Management’s factory index rose to 36.3 last month from 35.8 in February. Still, the contraction is very pronounced at this point.

The ISM’s gauge of inventories fell to 32.2, the lowest since August 1982, from 37 in February. Even as manufacturers are pushing their inventory levels down ISM representatives stressed “we’re probably two, three months away from seeing significant improvement in new orders that would be driven by customer inventories coming in line.”

Brazil

March data pointed to yet another weak performance of Brazil’s manufacturing economy despite the fact that the headline seasonally adjusted Banco Santander Purchasing Managers’ Index registered its highest reading since last October (42.2). Despite a slower contraction in output being recorded in March, the pace of decline remained substantial. The trend in production closely followed that of new orders, although another severe depletion in unfinished work prevented it from falling as severely. Stocks of finished goods were also lower than in February, and the latest data are consistent with a modest reduction in inventory holdings, with manufacturers frequently responding that orders had been met directly from existing stocks.Input and output prices fell at series record rates during March. The drop in purchasing costs was only the second in the survey history, and reflected weak global demand for fuel and raw materials. Manufacturers passed these reductions on to customers, by way of lower charges, in an effort to remain competitive in a difficult market environment

No comments:

Post a Comment