This post is essentially a research note on the current state of the Polish labour market. It forms part of a series of posts being prepared by

Global Economy Matters to accompany the up and coming Polish elections, which are due to be held this weekend. Alongside this post you can find a

general review of the electoral situation by Manuel Alvarez, and I will be writing additional notes on the Polsih trade balance and on migration and remittances in the Polsih context, while Claus Vistesen will be taking a look at indebtedness, capital flows and the current account balance situation. All in all a rather full analysis, which given the key role which Poland may play in any Eastern European emerging markets disarray is probably only fitting.

Now, at the end of September the Polish Statistical Office published

its unemployment report for the second quarter of 2007, and very interesting reading it is.

Before going into the details of the report, perhaps a bit of background information would be useful. First of all, economic growth. GDP has been growing at a pretty nifty clip in Poland in recent quarters, not as fast as in the Baltics, but pretty fast, as we can see in the chart below. Over the last twelve month the rate has been hovering in the 6% to 7% region.

Now the question is, is this growth sustainable? Stripped to its bare minimum, an economy needs three things for growth - labour, capital and raw materials - pretty much in the same way as a cement mixer needs sand, cement and water, all in the right proportions, of course. The analogy, in the present context, is not completely devoid of significance, since construction activity, and hence the production of cement, is an important part of the recent Polish story in its own right.

So as I say: is this sustainable? Well, capital is at present in pretty plentiful supply, although the danger does exist - since this capital is to a large extent not the product of domestic Polish savings - that this supply could dry up, and even be sucked backwards, as Claus will explain in his post. Raw material are available, but not always at the most favourable price, as we are currently seeing in relation to food and energy.

But what about labour? What is the position with the labour supply situation in Poland? Well this brings us directly to the tricky topic of Polish unemployment, which we will now proceed to explore.

Long Term Unemployment DeclineHistorically unemployment in Poland has been pretty high. Most recently it peaked in 2003, and has now been dropping for a number of years, as can be seen from the annual unemployment chart below.

If we come to look at the monthly unemployment data for the last twelve months then we can see that this decrease in unemployment has been accelerating steadily in recent times.

The decrease in the numbers of unemployed is in part, of course, a reflection of an increase in employment, and the volume of employment in Poland has, as can be seen below, been increasing steadily since the end of the contraction which took place between 1999 and 2004.

Here is the annualy % change in the volume of employment:

And here are the numbers of employed on a quarterly basis since the begining of 2004:

The number of people registered with the Polish labour offices as unemployed at the end of June 2007 was 1,895,100 (of which 1,107,700 were women). This constituted a reduction of 337,400 on the number of unemployed in March (the end of Q1). Compared with June 2006 unemployment was down by 592,500 (or by 23.8%). Thus, viewed on a quarterly basis, the decline has been very dramatic, as can be seen below.

Perhaps also worthy of note is the fact that the decline in the numbers of unemployed has been more rapid among men - 322,800 (or 29.1% of the total unemployed) - than among women 269,800 (or 19.6%).

When compared to June 2006 unemployment decreased in all the Polsish voivods, and the declines have been quite dramatic. The most significant declines took place in in Dolnośląskie (30.2%), Wielkopolskie (29.8%), Pomorskie (27.5%), Opolskie and Śląskie (26.8%).

(Please click over image for better viewing)

The unemployment percentage rate at the end of June 2007 was 12.4% of the economically active civilian population, and was thus 2.0 points lower than in Q1 2007, and 3.5 % points lower than in June 2006.

There is still considerable territorial difference in the levels of unemployment in Poland. The highest unemployment rate is to be found in the voivods of Warmińsko-Mazurskie (19.6%), Zachodniopomorskie (17.9%), Kujawsko- Pomorskie (16.2%) and Lubuskie (by 15.8%), while the lowest unemployment rate exists in the voivods of Wielkopolskie (9.3%), Małopolskie (9.5%), and Mazowieckie (10.2%).

(Please click over image for better viewing)

Looking at the two maps taken together, it is very clear that the area where labour tightening is most dramatic at the present moment is Wielkopolskie, since the unemployment rate is already comparatively low, and the pace of reduction in the unemployment rate is also pretty rapid. Wielkopolska Province is second in area and third in population among the sixteen Polish voivods, with a land area of 29,826 km² and a population of 3.4 million. The province's principal cities are Poznań, Leszno, Kalisz and Gniezno. It also hosts part of the Kostrzyn-Slubice Special Economic Zone.

In general terms what we can see is that as the Polish economy has been expanding, it has been consuming labour, and rapidly so. One interesting calculation here is to make an estimate of how much labour is needed to produce 1% of GDP growth with the current proportions of sand, cement and water which are being shoveled into the economic mixer (ie at today's rate of productivity increase). A rough and ready, rule of thumb type, calculation would tell us that to get 6% annual growth the unemployment roll is coming down by about 600,000 peopple per annum, that is that each annual percentage point of economic growth reduces the numbers of available unemployed by 100,000. (This

is a rough and ready calculation, but it is a more sophistocated one than first meets the eye, since it does, in approximate way, implicitly incorporate the ageing and withdrawal from the labour force dimension).

What this means quite simply is that, given the relatively low size of the younger cohorts about to enter the labour force, a 6% growth rate just is not sustainable for that much longer. If we imagine that unemployment could only with great difficulty fall below 500,000 without producing spiralling hyper-inflation, then we have an outer limit of 2 years at the present growth rate I think.

After that, what is the sustainable - capacity - growth rate? This is very hard to say without a much fuller econometric analysis, since it depends among other things on the direction and intensity of both migratory and capital flows. Many people, and especially those with a relatively poor understanding of how economic processses actually operate, tend to raise the objection at this point that such a calculation may not be accounting for productivity growth. This would be a mistake, and an elementary one, since the present rate of unemployment attrition already incorporates a certain level of productivity improvement.

So what such an argument normally wants to claim is that some sort of rapid improvment in the rate of productivity growth is on the horizon - rather like Alan Greenspan argued in the late 90s based on the arrival of the internet. A continuing increase in Polish productivity is, of course, to be expected, but it is not clear why people are expecting a dramatic

acceleration in the rate of productivity growth. If this expectation is to become more than a simple vain hope it does need some sort of analytical justification. In the meantime we might do well to bear in mind that such improvements are a by product of stocks and flow movements in human capital formation, which is why the age structure of the existing population, and their education level, is such an important topic.

So, if we said that between 2010 - 2012 Polish capacity economic growth might be something in the region of 2 to 3%, then we probably would not be that far from the mark. Post 2012 it is much harder to estimate things, especially since, among other issues, the ageing population component will begin to have an ever greater impact.

Labour QualityOne of the main issues on which we are focusing in this analysis is the rate of reduction of the unemployment level in Poland and the evolution of the future labour supply. It is important to be aware that this future evolution is in great part conditioned by two factors:

1) The very low numbers of live births (in historical terms) which there have been in Poland since the late 1980's and;

2) The relatively high levels of out migration which Poland has expecienced in the last three or four years, which mean certain key groups of workers in the main productive age ranges will not be available to Poland to fuel growth as we move forward.

I have a much fuller (examination of the Polish fertility vackground in this post , but the following graph should make the underlying position pretty clear:

Basically live births dropped from a level of around 700,000 per year in the mid 1980's to around 400,000 per annum in the mid 1990s. That is a net loss of 300,000 potential labour market entrants per year (or a reduction of around 40% in the labour flow, I can hear that cement mixer starting to crunch as I write), a loss which will increasingly make its presence felt between now and 2015.

With these points in mind it is interesting to note that in Q2 2007 the number of people who left the unemployment rolls was 873,000. The largest group who went off the unemployment rolls in Q2 2007 did so as a result of finding a job. In fact 364,000 people left the rolls to take up work in Q2 2007 (or 41.7% of the total leaving) as compared with 425,300 (or 46.8%) in Q2 2006.

It is also inetersting to note that during Q2 2007 264,900 people who were previously registered as unemployed did not confirm their readiness to take a job. This seems to suggest that the Polish authorities are busily cleaning up their unemployment registers - the reduction for "non-availability" constituted some 30.3% of the total reduction in the number of people on the unemployment rolls during the quarter (in Q2 2006 the figures were respectively 259,500 and 28.6%) - and many of the people removed were more than likely already working, whether the work in question was inside or outside of Poland.

So one part of the apparent Polish "reserve army" may in reality simply not exist. Another part may - speaking in plain English terms - be far from serviceable for modern economic growth purposes.

In this context it is interesting to note that the long-term unemployed constituted 65.7% of the Q2 2007 total (1,245,000), and many of these people may turn out to be very hard to "recycle" into the modern world. In terms of the relative age structure of the remaining unemployed, under 25 year olds constituted 18.9% of the total (358,600), while persons aged over 50 were 21.0% (398,1oo thous).

At the end of Q2 2007, 1,639,300 people on the rolls did not possess the right to unemployment benefit, and this group represented 86.5% of the total number of registered unemployed, (in the previous quarter it was respectively 1,930,700 and 86.5%). Among this group 43.4% were people living in rural areas.

There were also more female than male unemployed. At the end of Q2 2007 58.5% of the total unemployed were female, and this was up by 3.1 % points on Q2 2006. The highest percentage share of women in the total number of the unemployed is to be found in the Wielkopolskie (65.6%), Pomorskie (64.0%), Kujawsko-pomorskie (62.3%) and Małopolskie (61.5%)vovoids.

One of the key difficulties in evaluating the remaining unemployed labour force in Poland is getting a precise reading on the quality of the labour which remains available. It is hard to get a clear picture here, but one indication which is not without importance can be found in the fact that the majority of the unemployed registered in the labour offices were persons with relatively low levels of education. The share of registered unemployed who did not have any occupational qualification whatsoever was 30.7% of the total registered unemployed (582,000).

In addition the two largest groups among the unemployed were persons having only basic vocational orlower secondary education (30.1% of the total), or persons with only primary or even incomplete-primary education (32.5% of the total number of the unemployed registered at the end of June 2007). Combined these groups constitute 62.6% of the total number of the unemployed.

On the other hand some 22.3% of the total had the certificate of completion of post-secondary and vocational secondary schools, while 9% had completed secondary education and 6.1% were graduates from tertiary schools.

So, in conclusion, and to reiterate. Poland is facing a potentially very acute and imminent trade off between economic growth and inflationary cost push. Some indication of this can already be found in the producer price index, which has been coming under increasing pressure since early 2006:

The earlier interest rate tightening from the central bank seems to have had some sort of short term impact during the March to July period, but, as we can see, the thing now seems to be taking off again. This position is only even more strongly confirmed if we look at the construction producer cost index.

It is also very clear that the steady tightening of labour market conditions is having an impact of Polish wages and salaries.

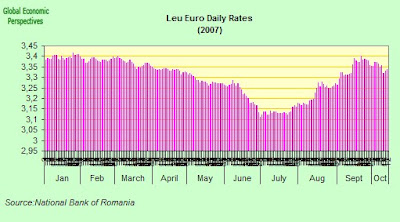

The annual rates of increase have been steadily picking up speed, and while they are still below those to be found elswhere in Eastern Europe (like the Baltics, Romania, Ukraine) the early warning signs of the "Baltic Syndrome" are there, which is hardly surprising since the underlying causes are essentially the same.

Information for this report comes, by and large from the Polish Statistical Office and Eurostat. In particular the recently publishedunemployment report for the second quarter of 2007 was evry useful, while additional information was taken from the Q2 2007 Labour Report (archive).