The rate of consumer-price inflation climbed to a one-year high of 6 percent, exceeding the bank's year-end target of 4 percent, plus or minus one percentage point.

Florin Citu, deputy head of financial markets at ING Bank Romania is quoted as saying that "The central bank cannot escape raising interest rates....It will be very hard for the central bank to explain if they chose not to raise rates, as inflation is going to reflect in wage requests too."

Personally I feel that this way of reading the inflation data - as being good for the leu if it is bad for the country - is something of a fools errand at this point, since the global markets are in the process of a major re-positioning, and we are all only waiting for Jean Claude Trichet to finally declare that the next move over at the ECB will be down for the whole show to get into full swing.

The real news of the moment is the Bulgarian inflation. The airwaves are rife with speculation following Bini Smaghi's ECB speech about how long those who are pegged to the euro can actually hang out in the current climate, and recent reports from the IMF and the World Bank singling out the labour shortage and current account deficit issues in the EU 10 will hardly help. So my feeling is that the leu will not be left on one side - in a kind of Ocean of tranquility - here. My only major question is which will come first, a run for cover by one of the peggers - Estonia perhaps - in breaking the peg, or a serious attack on the leu. It is hard to say really, but whichever comes first the other will follow soon behind. This is all what you could call a "done deal" now I'm afraid. The other big question is, of course, once it all starts, where exactly will it stop?

Nearly all the news out of Romania is bad at the moment - in the sense of showing ever increasing signs of overheating. The steadily declining unemployment, which means a tightening labour market and hence even more pressure on inflation, can hardly be called good news at this point, welcome as it would be in another moment.

The International Monetary Fund said earlier in the week after concluding a week-long visit to the Romania that inflation will be at 5 percent by year-end and that "inflation prospects for 2008 are worrying". Inflation prospects unfortunately are not the only thing which is worrying.

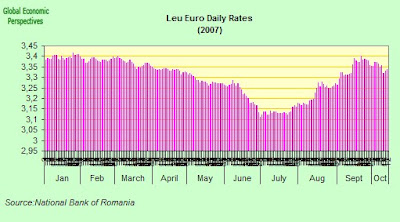

Against the euro, the leu touched 3.3298 at 6:05 p.m. in Bucharest on Thursday which was its highest level since Sept. 13. Despite this recent rebound however the leu has been the worst performer among emerging-market currencies in the past three months, dropping almost 7 percent as can be seen from the chart blow.

The reaction to financial market stress since the middle of August can be observed in the second chart.

However this placid climate may well be in the process of experiencing a sudden reversal following the release by the National Bank of Romania of Romania's Current Account data for the January-August 2007 period this morning. Although the deficit virtually doubled over the same period in 2006, there is little here to add to the news on the trade deficit last Friday, since, as the bank say in their press release:

In January-August 2007, the balance-of-payments current account posted a deficit of EUR 10,228 million. This development can be ascribed mainly to the wider trade deficit, which amounted to EUR 10,864 million, up 69 percent from the same period of last year.Romania's trade deficit in fact increased in August 2007 when compared with August 2006 as the elimination of trade barriers following European Union entry and the impact of a stronger currency encouraged Romanians to buy ever more goods from abroad.

The deficit widened to 1.77 billion euros in August from 1.3 billion euros in August 2006, according to the National Statistics Institute at the end of last week (these calculations are based on preliminary data). The actual deficit remained by and large unchanged when compared with the revised deficit of 1.81 billion euros registered in July.

A strong inward flow of funds into Romania (especially including remittances) since joining the EU last January has strengthened the leu, and this has made imports cheaper. The leu - even despite the recent decline - has still gained 18 percent against the dollar and 4.7 percent against the euro over the past year.

In addition Romania became a net grain importer in the second half of the year after months of record-high temperatures and low rainfall badly affected corn and wheat crops. The drought damaged two-thirds of the 6 million hectares of crops planted this year and destroyed about 1 million hectares.

Imports in August rose an annual 18.6 percent to 3.99 billion euros, while exports increased 7.6 percent to 2.22 billion euros. Imports from other EU countries rose 20 percent as exports to the bloc increased 9.1 percent.

In the first eight months of the year, the trade deficit widened to 13.35 billion euros from 8.38 billion euros in the same period of last year. Imports increased 27.5 percent and exports rose 11.8 percent.

According to the central bank, foreign direct investment in the first eight months of the year fell to 4.06 billion euros from 4.3 billion euros in the same period last year. Long-term foreign debt rose 19 percent at the end of August from Dec. 31 to 33.9 billion euros.

At the same time, those of you who doubt the importance of all those Romanians working abroad, should note that money transfers to Romania, which come mostly from citizens sending money home from abroad, rose to 3.49 billion euros in the period from 2.77 billion euros a year earlier.

Here for good measure is a graph showing those Romanians currently registered with the Spanish authorities and living and working (in the case of those of working age, which are the vast majority) in Spain.

The very tiny bars that you can see in red alongside the main bars are the numbers of migrants that the Romanian authorities recognise as being migrants aboroad in the sense of having "permanently" emigrated. Whether they have left permanently or not seems at this moment in time to be beside the point. They are not available for work in Romania, they are sending money home to fuel consumption, and as a consequence of the combination of these two factors inflation is starting to head for the ceiling.

All in all, a pretty bleak situation. Bloomberg again quote Florin Citu, deputy head of financial markets at ING Bank in Bucharest, this morning as saying:

And I'm afraid I cannot but agree. The leu, of course, was under pressure again this morning, and at the time of writing is down at 3.3397 to the euro. I am convinced that the whole situation in the EU 10 is now unsustainable, and that an important correction is coming, the only real doubt in my mind is whether the correction will start with a run on the leu or with one of the euro peggers - Bulgaria, Latvia, Estonia and Lithuania - making a run for cover and breaking the peg.

"The deficit this year will be humongous.....The question is whether this will be worked out gradually or by a sudden drop in the leu and a drop in economic growth. If I were a betting man, I would go for the latter."

Time, as always, will tell.

Postscript

A much fuller appreciation of the imminence of an emerging market correction in Eastern Europe, and the factors which lie behind it, can be found here.

No comments:

Post a Comment